Flood insurance policies are a crucial safety net for homeowners, protecting them from the devastating financial impacts of floods. From statistics on property damage to coverage types, this guide explores everything you need to know about flood insurance policies.

Let’s dive into the world of flood insurance and uncover the key aspects that every homeowner should be aware of.

Importance of Flood Insurance Policies

Having flood insurance is crucial for homeowners to protect their property and finances in the event of a flood.

Number of Properties Affected by Floods Annually

Each year, thousands of properties across the country are affected by floods, leading to significant damage and financial losses for homeowners.

Financial Implications of Not Having Flood Insurance

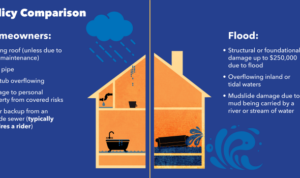

Not having flood insurance can result in devastating financial consequences for homeowners, as most standard homeowners insurance policies do not cover flood damage. This can leave homeowners with costly repairs and rebuilding expenses that can be financially crippling.

Types of Flood Insurance Policies

When it comes to flood insurance, there are primarily two types of policies available – the National Flood Insurance Program (NFIP) and private flood insurance.

NFIP:

The NFIP is a government-run program that offers flood insurance to homeowners, renters, and businesses in participating communities. It provides coverage for both the structure of the property and its contents. One of the key advantages of NFIP is that it is widely available and can be purchased through insurance agents who participate in the program. However, the coverage limits are capped at $250,000 for residential buildings and $100,000 for contents, which may not be sufficient for some properties.

Private Flood Insurance:

Private flood insurance is offered by private insurance companies and typically provides higher coverage limits compared to NFIP policies. These policies may also offer additional coverage options that are not available through NFIP, such as coverage for additional living expenses or replacement cost coverage for personal belongings. However, private flood insurance policies are not as widely available as NFIP policies and may be more expensive.

In conclusion, the choice between NFIP and private flood insurance ultimately depends on individual needs and preferences. NFIP may be a more accessible and affordable option for some, while others may prefer the higher coverage limits and additional benefits offered by private flood insurance.

Factors Affecting Flood Insurance Premiums: Flood Insurance Policies

When it comes to flood insurance premiums, several factors come into play that can impact how much you have to pay for coverage. Factors like location, flood risk, and property value all play a role in determining your insurance rates. Additionally, taking steps to mitigate the risk of flooding on your property can also help lower your premiums.

Location

The location of your property is a significant factor in determining your flood insurance premiums. Properties located in high-risk flood zones, such as coastal areas or near rivers, are more likely to experience flooding and therefore may have higher insurance rates compared to properties in low-risk areas.

Flood Risk

The level of flood risk associated with your property also affects your insurance premiums. Properties with a higher likelihood of flooding, based on factors like elevation and proximity to bodies of water, will generally have higher insurance rates to reflect the increased risk of damage from flooding.

Property Value

The value of your property is another factor that can impact your flood insurance premiums. More expensive properties may have higher premiums since the cost of repairing or replacing the property in the event of a flood would be greater. Insurers take property value into account when determining the level of coverage needed and the corresponding premium amount.

Mitigation Efforts

Taking steps to mitigate the risk of flooding on your property can help lower your flood insurance premiums. Measures such as installing flood barriers, raising electrical systems, or elevating your property can reduce the likelihood of damage from flooding, making your property less risky to insure. Insurers often offer discounts for properties with effective mitigation efforts in place.

Making a Claim under a Flood Insurance Policy

When it comes to making a claim under a flood insurance policy, there are specific steps that need to be followed to ensure a smooth process. It’s essential to understand what documentation is required and how the claim assessment and reimbursement process works.

Steps Involved in Filing a Claim for Flood Damage, Flood insurance policies

- Contact your insurance company as soon as possible after the flood to report the damage.

- Document the damage by taking photos or videos of the affected areas.

- Make a list of damaged or lost items, including their value and any receipts you may have.

- Fill out the necessary claim forms provided by your insurance company.

- Cooperate with the insurance adjuster who will assess the damage and determine the coverage amount.

Documentation Required When Making a Claim

- Photos or videos of the flood damage.

- Inventory of damaged or lost items with their value and receipts, if available.

- Copy of your flood insurance policy.

- Any communication with your insurance company regarding the claim.

Process of Claim Assessment and Reimbursement

- After filing the claim, an insurance adjuster will visit your property to assess the damage.

- The adjuster will determine the coverage amount based on the policy terms and the extent of the damage.

- Once the assessment is completed, the insurance company will provide reimbursement for the covered losses.

- Reimbursement can be in the form of a check or direct deposit, depending on your preference and the insurance company’s procedures.