Passive income ideas are all the rage right now, as everyone wants to make money without lifting a finger. From real estate investments to online business ventures, let’s dive into the world of generating income effortlessly.

Passive Income Ideas

Passive income is money earned with minimal effort or ongoing work required to maintain it. Unlike active income, which involves trading time for money, passive income allows you to make money while you sleep. It provides financial freedom, flexibility, and the potential to grow your income streams without being tied to a traditional 9-5 job.

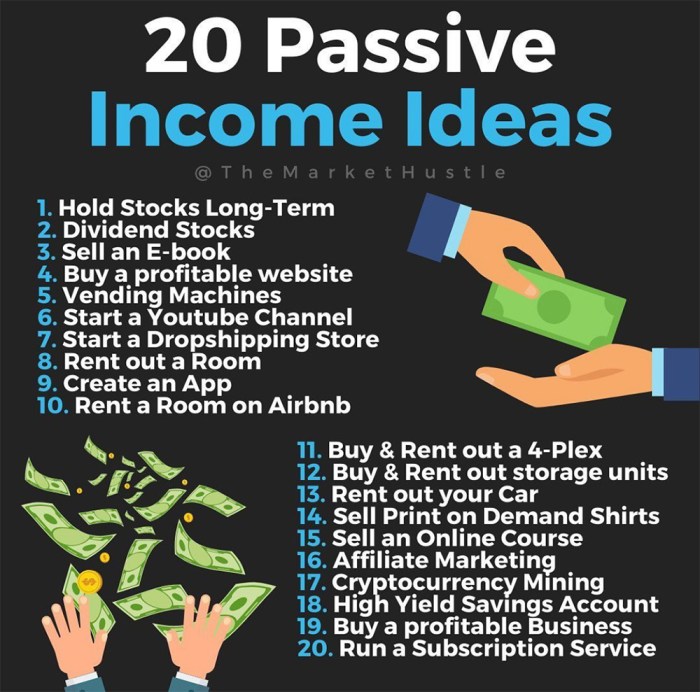

List of Popular Passive Income Ideas:

- Investing in dividend-paying stocks

- Rental income from real estate properties

- Creating and selling digital products online

- Peer-to-peer lending

- Starting a blog or YouTube channel with affiliate marketing

Real Estate Investments

Real estate can be a lucrative source of passive income, allowing investors to earn money through rental properties, real estate investment trusts (REITs), or real estate crowdfunding without actively managing the properties themselves.

Passive Income Opportunities in Real Estate

- Investing in Rental Properties: Purchasing residential or commercial properties and renting them out to tenants can provide a steady stream of passive income through monthly rental payments.

- Real Estate Investment Trusts (REITs): Investing in REITs allows individuals to own shares in real estate portfolios without directly owning properties. Investors receive dividends from the rental income generated by the underlying properties.

- Real Estate Crowdfunding: Platforms like Fundrise or RealtyMogul enable individuals to invest in real estate projects alongside other investors. Passive income is generated through rental income, property appreciation, or interest payments.

Pros and Cons of Investing in Rental Properties for Passive Income

- Pros:

- Potential for high returns through rental income and property appreciation.

- Tax advantages such as deductions for mortgage interest, property taxes, and depreciation.

- Diversification of investment portfolio with a tangible asset.

- Cons:

- Responsibility for property maintenance, tenant management, and dealing with vacancies.

- Market fluctuations affecting property values and rental demand.

- Initial capital required for property purchase and ongoing expenses.

Online Business Ventures

Online business ventures are a popular way to generate passive income in today’s digital world. By leveraging the power of the internet, entrepreneurs can create scalable business models that can generate income with minimal ongoing effort. Whether it’s selling products, offering services, or creating digital content, online businesses offer a wide range of opportunities for passive income generation.

Successful Online Business Models

- Affiliate Marketing: By promoting products or services from other companies, affiliate marketers can earn a commission for each sale or lead generated through their referral link.

- Dropshipping: This e-commerce model allows entrepreneurs to sell products to customers without holding any inventory. The supplier ships the product directly to the customer, and the entrepreneur earns a profit on the price difference.

- Online Courses: Creating and selling online courses on platforms like Udemy or Teachable can generate passive income as students enroll in the course and pay for access to the content.

Scalability of Online Business Ventures

Online business ventures have the advantage of being highly scalable. Once a successful business model is established, entrepreneurs can easily scale up by reaching a larger audience, expanding product offerings, or automating processes. This scalability allows for exponential growth in passive income generation without a proportional increase in time and effort.

Dividend Stocks and Investments

When it comes to generating passive income, dividend stocks are a popular choice among investors. These stocks are shares of companies that distribute a portion of their profits to shareholders in the form of dividends. Here’s how dividend stocks work as a form of passive income:

Selecting Dividend-Paying Investments

- Look for companies with a history of consistent dividend payments.

- Consider the dividend yield, which is the annual dividend payment divided by the stock price.

- Evaluate the company’s financial health and growth potential to ensure sustainability of dividends.

- Diversify your portfolio by investing in different sectors and industries.

Benefits of Dividend Stocks

- Regular income: Dividend payments provide a steady stream of passive income.

- Potential for growth: Reinvesting dividends can help compound returns over time.

- Lower volatility: Dividend-paying stocks tend to be more stable during market fluctuations.

- Tax advantages: Qualified dividends are taxed at a lower rate than other forms of income.

Peer-to-Peer Lending: Passive Income Ideas

Peer-to-peer lending platforms provide an alternative way to invest money and generate passive income. Instead of dealing with traditional financial institutions, individuals can directly lend money to other individuals or small businesses through online platforms. This allows investors to earn interest on their funds while borrowers can access financing outside of the traditional banking system.

How Peer-to-Peer Lending Works

- Investors create an account on a peer-to-peer lending platform and deposit funds to lend out.

- Borrowers apply for loans on the platform, providing information about their creditworthiness and the purpose of the loan.

- Investors can browse through different loan listings and choose which ones to fund based on the borrower’s profile and the interest rate offered.

- Once the loan is funded, borrowers make regular payments that include both the principal amount and interest.

- Investors receive a portion of these payments as returns on their investment.

Risks and Rewards, Passive income ideas

- Rewards: Investors can earn higher returns compared to traditional savings accounts or CDs. The interest rates offered on peer-to-peer loans are often competitive, providing an opportunity for passive income generation.

- Risks: There are risks involved in peer-to-peer lending, such as the potential for borrowers to default on their loans. In such cases, investors may lose a portion of their principal amount. Additionally, the lack of FDIC insurance means that there is no guarantee of recovering lost funds.

Maximizing Returns

- Diversify your investments by spreading your funds across multiple loans to reduce the impact of any defaults.

- Conduct thorough due diligence on borrowers by reviewing their credit history, income sources, and loan purpose to minimize the risk of defaults.

- Reinvest your returns by continuously funding new loans to take advantage of compounding interest and maximize your overall returns.