Flood insurance policies are crucial for protecting your assets during unforeseen disasters. From understanding coverage to filing claims, here’s everything you need to know.

Dive into the world of flood insurance policies to ensure you’re prepared for any potential water-related emergencies that may come your way.

Overview of Flood Insurance Policies

Flood insurance policies are essential for homeowners living in areas prone to flooding. These policies provide financial protection in case of flood-related damages to your property.

Typical Coverage Included in Flood Insurance Policies

- Structural coverage: This includes coverage for the building itself, including the foundation, walls, and roof.

- Personal property coverage: This covers your belongings inside the property, such as furniture, appliances, and clothing.

- Additional living expenses: In case your home becomes uninhabitable due to flooding, this coverage helps with temporary living arrangements.

Government-Backed vs. Private Flood Insurance Policies

- Government-backed policies: These are provided through the National Flood Insurance Program (NFIP) and have set coverage limits. Premiums are determined based on factors like location and property value.

- Private flood insurance policies: Offered by private insurance companies, these policies may provide higher coverage limits and additional benefits. Premiums are determined based on individual risk factors and coverage needs.

Determining Flood Insurance Coverage

Determining the right amount of coverage for flood insurance is crucial to protect your property and belongings in case of a flood. Here are some tips to help you make an informed decision:

Factors Influencing Coverage Amount

- Consider the value of your property: Determine the replacement cost of your home and personal belongings to ensure you have adequate coverage.

- Evaluate the flood risk in your area: Properties in high-risk flood zones may require higher coverage limits.

- Assess your financial situation: Consider how much you can afford to pay out of pocket in case of flood damage.

Factors Affecting Premium Costs

- Location of the property: Properties located in high-risk flood zones will have higher premiums.

- Building’s elevation: Higher elevation can lower premium costs as it reduces the risk of flood damage.

- Type of coverage: Different coverage options such as building property coverage and personal property coverage will impact premiums.

Understanding Coverage Limits and Exclusions

- Know your policy limits: Be aware of the maximum amount your insurance provider will pay out for flood damage.

- Review exclusions: Understand what is not covered by your policy, such as damage from neglect or gradual erosion.

- Consider additional coverage: Evaluate the need for additional coverage for items like basement improvements or temporary housing expenses.

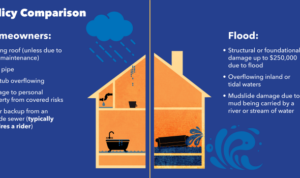

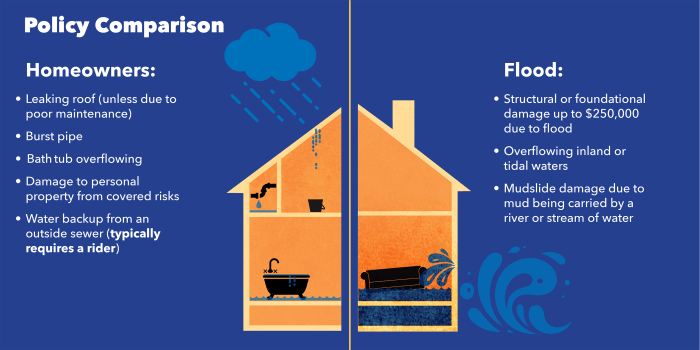

Types of Flood Insurance Policies

When it comes to flood insurance policies, there are different options available in the market to cater to various needs and situations. Let’s take a look at the types of flood insurance policies and how they differ from each other.

Residential Flood Insurance Policies vs Commercial Flood Insurance Policies

Residential flood insurance policies are designed to protect homeowners from flood damage to their properties and belongings. These policies typically cover the structure of the home as well as personal belongings inside. On the other hand, commercial flood insurance policies are tailored for businesses and commercial properties. They provide coverage for both the building structure and business assets that may be affected by flooding.

Specialized Flood Insurance Policies for High-Risk Areas or Properties

In high-risk flood areas or properties, specialized flood insurance policies may be necessary to provide adequate coverage. These policies often come with higher premiums but offer additional protection and benefits. For example, properties located in flood zones or coastal areas prone to hurricanes may require specialized flood insurance to ensure full coverage in case of a disaster.

Filing Claims with Flood Insurance: Flood Insurance Policies

When it comes to filing a flood insurance claim, it’s important to act quickly and efficiently to ensure a smooth process. Documenting and reporting flood damage accurately is key to getting the compensation you deserve. Let’s dive into the details of how to navigate the claims process and what to expect.

Tips for Documenting and Reporting Flood Damage

- Take photos and videos of the damage: Before starting any cleanup or repairs, document the extent of the damage with clear photos and videos. This visual evidence will support your claim.

- Make a detailed inventory: List all damaged items and their value. Include receipts, invoices, and any other relevant documentation to substantiate your losses.

- Keep track of expenses: Save all receipts related to flood damage, such as cleanup costs, temporary housing, and repairs. These expenses may be covered by your insurance policy.

- Report the damage promptly: Contact your insurance provider as soon as possible to report the damage and start the claims process. Delays could impact your claim.

Role of Adjusters in Assessing Flood Damage

- Assessing the damage: Insurance adjusters will visit your property to evaluate the extent of the flood damage. They will inspect the property, review your documentation, and determine the coverage amount.

- Processing the claim: Adjusters play a crucial role in processing your claim and determining the compensation you are entitled to receive. Their assessment will influence the outcome of your claim.

- Communication: Stay in contact with the adjuster throughout the claims process. Provide any additional information or documentation requested promptly to expedite the assessment and settlement.