Flood insurance policies set the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with American high school hip style and brimming with originality from the outset. From the importance of having flood insurance to the various policy types and factors affecting premiums, this discussion dives deep into the world of flood insurance policies.

Importance of Flood Insurance Policies

Having flood insurance is crucial for homeowners to protect their property and finances in case of unexpected flooding events.

Risks of Not Having Flood Insurance

Not having flood insurance can leave homeowners vulnerable to financial devastation in the event of a flood. Without coverage, homeowners may have to pay out of pocket for costly repairs, replacements, and temporary housing.

Examples of Flood Insurance Saving the Day

- Flooding caused by a severe storm damages a homeowner’s basement, destroying valuable items and causing structural damage. With flood insurance, the homeowner is able to file a claim and receive financial assistance to repair the damages.

- A nearby river overflows, inundating a neighborhood with water. Homeowners who have flood insurance are able to recover their losses and rebuild their homes, while those without coverage face significant financial setbacks.

- A flash flood hits a coastal town, damaging multiple homes and properties. Homeowners who had the foresight to invest in flood insurance are able to recover quickly and resume their lives, while those without coverage struggle to recover financially.

Types of Flood Insurance Policies

When it comes to flood insurance, there are different types of policies available to provide coverage in case of a flood disaster. Let’s take a closer look at the various options and understand their differences.

NFIP (National Flood Insurance Program)

The NFIP is a government-run program that offers flood insurance to property owners, renters, and businesses in participating communities. It provides coverage for building property and contents separately, with different limits for each. NFIP policies have set coverage limits and exclusions, so it’s essential to review the policy details carefully.

Private Flood Insurance

Private flood insurance is offered by private insurance companies and may provide more flexibility in coverage options compared to NFIP policies. These policies can offer higher coverage limits and additional coverage options tailored to individual needs. However, the cost of private flood insurance may vary depending on the provider and the level of coverage chosen.

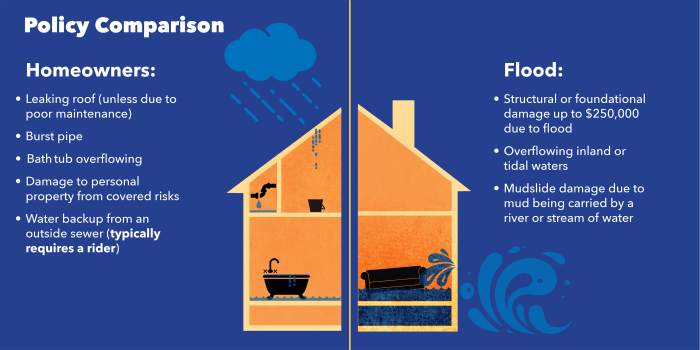

Coverage Limits and Exclusions

Flood insurance policies, whether through NFIP or private insurers, have specific coverage limits and exclusions that policyholders should be aware of. It’s crucial to understand what is covered and what is not to avoid any surprises in the event of a flood. Common exclusions in flood insurance policies may include damages caused by neglect, earth movement, sewer backups, and more.

Factors Affecting Flood Insurance Premiums

When it comes to determining flood insurance premiums, there are several key factors that come into play. Factors such as location, property type, and flood zone can have a significant impact on the cost of your flood insurance policy. Additionally, taking certain mitigation measures can potentially help reduce your premiums.

Location

The location of your property plays a crucial role in determining your flood insurance premiums. Properties located in high-risk flood zones are more likely to experience flooding, which means higher premiums. On the other hand, properties in low to moderate-risk zones may have lower premiums.

Property Type

The type of property you own also affects your flood insurance premiums. Factors such as the age of the property, elevation, and construction materials can impact the cost of your policy. For example, older properties or those made of materials prone to water damage may have higher premiums.

Flood Zone

The flood zone in which your property is located is a key factor in determining your flood insurance premiums. Properties in special flood hazard areas (SFHAs) are at a higher risk of flooding and therefore have higher premiums. Understanding the flood zone of your property is essential in assessing your insurance needs.

Mitigation Measures

Taking proactive steps to mitigate the risk of flooding can potentially help reduce your flood insurance premiums. Measures such as installing flood vents, elevating utilities, and reinforcing the foundation of your property can demonstrate to insurers that you are taking steps to protect your property from flooding. By investing in mitigation measures, you may be able to lower your insurance costs over time.

Claims Process for Flood Insurance

When it comes to filing a flood insurance claim, there are specific steps that homeowners need to follow to ensure a smooth process. This includes documenting the damage, submitting the claim, and working with the insurance company to get the necessary funds for repairs.

Filing a Flood Insurance Claim

- Document the damage: Take photos and videos of the affected areas to provide visual evidence of the flood damage.

- Contact your insurance company: Notify your insurance provider as soon as possible to start the claims process.

- Submit the claim: Fill out the necessary forms and provide all required documentation to support your claim.

- Work with the adjuster: An insurance adjuster will assess the damage and determine the amount of coverage you are eligible for.

Documentation Required for Flood Insurance Claim

- Proof of loss: This includes a detailed list of damaged items, their original value, and receipts if available.

- Repair estimates: Get estimates from contractors for the cost of repairs and replacements.

- Insurance policy: Provide a copy of your flood insurance policy to verify coverage details.

- Additional documentation: Any other relevant documents such as inspection reports or communication with the insurance company.

Tips for Homeowners in Navigating the Claims Process, Flood insurance policies

- Act quickly: Notify your insurance company as soon as possible to start the claims process promptly.

- Keep detailed records: Document all communication with the insurance company and keep track of all paperwork related to your claim.

- Stay organized: Keep all receipts, estimates, and other documentation in one place for easy access during the claims process.

- Ask questions: If you are unsure about any part of the claims process, don’t hesitate to ask your insurance provider for clarification.

Changes in Flood Insurance Regulations

Recent updates in flood insurance regulations have brought about significant changes that impact both homeowners and insurers. These changes are crucial in shaping the landscape of flood insurance policies and ensuring adequate coverage for those at risk.

Impact on Homeowners

- Increased Premiums: With new regulations, homeowners may see an increase in their flood insurance premiums to reflect the updated risk assessment.

- Eligibility Criteria: Changes in regulations may affect the eligibility criteria for obtaining flood insurance, potentially leaving some homeowners without coverage.

- Policy Coverage: The scope of coverage provided by flood insurance policies may change as regulations are updated, affecting what damages are included and excluded.

Impact on Insurers

- Risk Assessment: Insurers will need to adjust their risk assessment models to align with the new regulations and ensure accurate pricing of flood insurance policies.

- Compliance Costs: Compliance with the updated regulations may lead to increased administrative costs for insurers, potentially impacting the affordability of flood insurance.

- Market Competition: Changes in regulations could also impact the competitive landscape among insurers, influencing the availability and pricing of flood insurance policies in the market.

Upcoming Trends

- Increased Digitalization: With changing regulations, there is a growing trend towards digitalization in the flood insurance sector, making it easier for homeowners to purchase and manage their policies online.

- Customized Coverage Options: Insurers are expected to offer more customized coverage options to homeowners, allowing them to tailor their policies based on individual risk factors and preferences.

- Climate Change Adaptation: Future regulations may place a stronger emphasis on climate change adaptation and resilience, influencing the design and pricing of flood insurance policies.

Case Studies and Real-Life Examples

Flood insurance policies have played a crucial role in helping homeowners recover from devastating flood events. Let’s explore some real-life examples that highlight the importance of having flood insurance coverage.

Case Study 1: The Smith Family

- The Smith family lived in a flood-prone area but were hesitant to invest in flood insurance due to the additional cost. Unfortunately, a severe storm caused their basement to flood, damaging their home’s foundation and belongings.

- With the help of their flood insurance policy, the Smith family was able to receive financial assistance to repair their home and replace the damaged items. This coverage saved them from facing a significant financial burden on their own.

Case Study 2: The Johnsons’ Success Story

- The Johnsons had flood insurance for their home, even though they were located in a moderate flood risk zone. When a nearby river overflowed due to heavy rains, their house was flooded up to the first floor.

- Thanks to their flood insurance policy, the Johnsons were able to rebuild their home and replace their furniture and appliances without worrying about the high costs. This experience emphasized the importance of being adequately insured against potential flood risks.