Welcome to the ultimate home insurance guide, where we break down the essentials of protecting your abode in style. From understanding different coverage options to tips on making a claim, get ready to dive into the world of home insurance like never before.

Understanding Home Insurance

Home insurance is a type of property insurance that provides coverage for private residences. It is important because it helps protect homeowners from financial losses due to damage or destruction of their homes, as well as liability for accidents that occur on their property.

Types of Home Insurance Coverage

- Dwelling Coverage: This type of coverage protects the structure of the home itself, including walls, roof, and foundation, from perils like fire, wind, and hail.

- Personal Property Coverage: This coverage protects personal belongings inside the home, such as furniture, clothing, and electronics, in case they are damaged, stolen, or destroyed.

- Liability Coverage: Liability coverage protects homeowners in case someone is injured on their property and decides to sue for damages.

Common Exclusions in Home Insurance

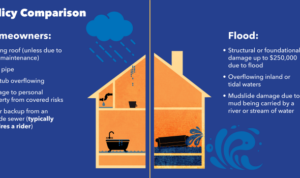

- Floods: Standard home insurance policies typically do not cover damage caused by floods. Homeowners may need to purchase a separate flood insurance policy to protect against this risk.

- Earthquakes: Similar to floods, earthquakes are usually not covered in standard home insurance policies. Homeowners in earthquake-prone areas may need to buy additional coverage.

- Routine Maintenance: Home insurance does not cover regular maintenance tasks like repairing a leaky roof or replacing an old appliance. It is meant to protect against sudden and accidental damage.

Factors Affecting Home Insurance Premiums

When it comes to determining how much you’ll pay for home insurance, several factors come into play. Let’s take a look at some key elements that can impact your home insurance premiums.

Location Impact on Home Insurance Rates

The location of your home plays a significant role in determining your insurance rates. Homes located in areas prone to natural disasters like hurricanes, earthquakes, or floods typically have higher premiums due to the increased risk of damage. Similarly, homes in high-crime areas may also face higher insurance costs.

Age and Condition of Home Influence on Premiums

The age and condition of your home can also affect your insurance premiums. Older homes or properties in poor condition may be more susceptible to damage, leading to higher insurance costs. Regular maintenance and upgrades can help mitigate these risks and potentially lower your premiums.

Coverage Limits and Deductible Impact on Cost

The coverage limits and deductible you choose for your home insurance policy can impact the overall cost. Opting for higher coverage limits or a lower deductible may result in higher premiums, but it can provide more comprehensive coverage in the event of a claim. On the other hand, choosing lower coverage limits or a higher deductible can help reduce your premiums but may leave you with higher out-of-pocket costs in the event of a claim.

Tips for Choosing the Right Home Insurance: Home Insurance Guide

When it comes to selecting the right home insurance policy, there are several important factors to consider. By comparing different insurance providers and their offerings, you can ensure that you are getting the coverage you need at a price that fits your budget. It is also crucial to regularly review and update your home insurance policy to make sure it continues to meet your needs as your circumstances change.

Checklist of Factors to Consider:

- Coverage Limits: Make sure the policy provides adequate coverage for your home and belongings.

- Deductibles: Consider how much you are willing to pay out of pocket before insurance kicks in.

- Add-Ons: See if there are any additional coverage options you may need, such as flood or earthquake insurance.

- Discounts: Inquire about any discounts available, such as bundling with auto insurance or installing security systems.

Comparing Insurance Providers:

It is essential to research and compare various insurance providers to find the best policy for your needs. Look at factors like customer reviews, financial stability, and claim processing efficiency to make an informed decision.

Reviewing and Updating Your Policy:

- Annual Review: Take the time to review your policy annually to ensure it still provides adequate coverage.

- Life Changes: Update your policy whenever you experience significant life changes, such as renovations or additions to your home.

- Policy Adjustments: Work with your insurance provider to make any necessary adjustments to your policy based on your current situation.

Making a Home Insurance Claim

When disaster strikes and you need to make a home insurance claim, it’s important to understand the steps involved and what documentation you’ll need to provide to ensure a smooth process with your insurance provider.

Steps Involved in Filing a Home Insurance Claim, Home insurance guide

- Contact your insurance provider as soon as possible to report the claim and provide details of the incident.

- Document the damage with photos or videos to support your claim.

- Fill out the necessary claim forms provided by your insurance company.

- Be prepared to schedule a visit from an insurance adjuster to assess the damage.

- Review and understand your policy coverage to know what is included in your claim.

Documentation Required When Making a Claim

- Proof of loss form detailing the items damaged or lost.

- Receipts or invoices for damaged belongings or repairs.

- Police reports (if applicable).

- Any relevant medical reports or bills (if someone was injured on your property).

- Any other documentation requested by your insurance provider.

Tips for a Smooth Claims Process

- Keep detailed records of all communications with your insurance company, including phone calls and emails.

- Follow up with your insurance provider regularly to stay informed of the progress of your claim.

- Be honest and accurate in your claim information to avoid delays or denials.

- Ask questions if you don’t understand any part of the claims process or your coverage.

- Consider hiring a public adjuster if you’re having difficulty with the insurance company’s assessment.