Dive into the world of insurance claims process where efficiency meets challenges head-on, from navigating documentation requirements to understanding the role of insurance adjusters. Get ready for a rollercoaster ride through the complexities of different types of insurance claims and common hurdles faced in the industry.

Learn about the latest technological advancements revolutionizing the claims process and how data analytics plays a crucial role. Discover best practices for effective customer communication and ways to enhance transparency in claims handling.

The Insurance Claims Process

When it comes to dealing with insurance claims, there are several important steps to keep in mind. From documenting the incident to working with insurance adjusters, the process can be complex but essential for receiving compensation in times of need.

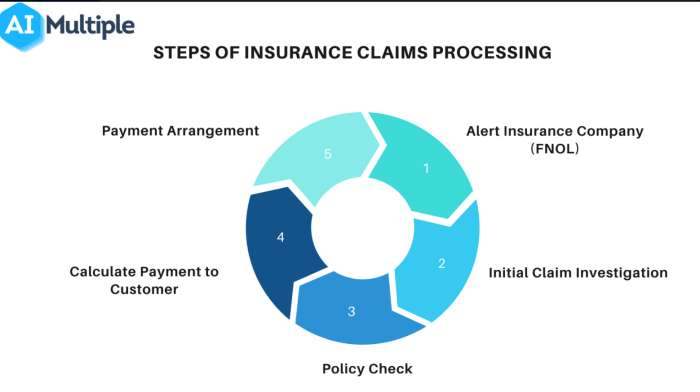

Steps in the Insurance Claims Process

- Report the Incident: Notify your insurance company as soon as possible after an incident occurs.

- Document the Damage: Take photos and gather any relevant information to support your claim.

- File a Claim: Submit all necessary documentation to your insurance company to start the claims process.

- Assessment: An insurance adjuster will assess the damage and determine the coverage provided under your policy.

- Resolution: Once the claim is approved, you will receive compensation for the damages covered by your policy.

Documentation Required during an Insurance Claim

- Claim Form: Fill out the necessary paperwork provided by your insurance company.

- Police Report: In the case of accidents or criminal activities, a police report may be required.

- Receipts and Invoices: Provide any receipts or invoices related to the damages or losses incurred.

- Witness Statements: Statements from witnesses can help support your claim.

Role of Insurance Adjusters

Insurance adjusters play a crucial role in processing claims by investigating the incident, assessing the damage, and determining the coverage under your policy. They act as intermediaries between you and the insurance company to ensure a fair and timely resolution.

Importance of Accuracy and Timeliness

- Accuracy: Providing accurate information and documentation is crucial for a successful claim process.

- Timeliness: Submitting your claim promptly can help expedite the processing and resolution of your claim.

- Review: Double-check all information before submitting to avoid delays or complications in the claims process.

Types of Insurance Claims

Insurance claims can be categorized into different types based on the nature of the coverage and the parties involved. Let’s explore the distinctions between first-party and third-party claims, the process of filing property damage insurance claims, the unique aspects of health insurance claims processing, and the differences in the claims process for auto insurance and life insurance.

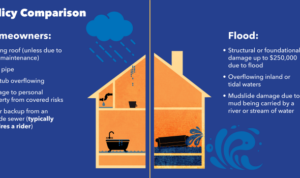

First-Party vs. Third-Party Insurance Claims

First-party insurance claims involve the policyholder seeking compensation from their own insurance company for damages or losses covered under their policy. On the other hand, third-party insurance claims occur when a claim is filed against the insurance policy of another party, usually due to liability for damages or injuries caused by the policyholder.

Property Damage Insurance Claims Process

When filing property damage insurance claims, the policyholder typically needs to provide documentation such as photos of the damage, estimates for repairs, and a detailed description of the incident. The insurance company will then assess the claim and determine the coverage amount based on the policy terms and conditions.

Health Insurance Claims Processing

Health insurance claims processing involves submitting medical bills and treatment records to the insurance company for reimbursement. The insurance provider will review the claim to ensure it meets the policy guidelines and may require additional information before approving the payment.

Auto Insurance vs. Life Insurance Claims

Auto insurance claims are usually filed after a car accident or theft, with the policyholder providing details of the incident and any relevant police reports. Life insurance claims, on the other hand, are typically filed by beneficiaries after the policyholder’s death, requiring a death certificate and other necessary documentation for the claim to be processed.

Common Challenges in Insurance Claims: Insurance Claims Process

When it comes to insurance claims, there are several common challenges that policyholders may face throughout the process. From claim denials to delays in investigations, navigating the world of insurance can be tricky. Let’s take a closer look at some of the most prevalent issues and how they can impact the claims process.

Reasons for Claim Denials

- Insufficient documentation: Providing incomplete or inaccurate information can lead to claim denials.

- Policy exclusions: Claims for events not covered under the policy may be denied.

- Lack of coverage: If the claim falls outside the scope of the policy, it may be denied.

Strategies for Appealing Denied Claims

- Review the denial letter: Understand the reason for the denial and gather any missing information.

- Submit an appeal: Provide additional documentation or evidence to support your claim.

- Seek assistance: Consider contacting a legal professional or insurance advocate for guidance.

Impact of Insurance Fraud

Insurance fraud can have a significant impact on the claims process, leading to increased premiums for policyholders and decreased trust in the industry. It is essential to be aware of the signs of insurance fraud and report any suspicious activity to your insurance provider.

Delays in Claim Investigations

- Complex cases: Claims involving multiple parties or extensive damage may take longer to investigate.

- Lack of cooperation: Failure to provide necessary information or documentation can result in delays.

- Understaffing: Insurance companies with limited resources may experience delays in processing claims.

Improving the Claims Process

In order to enhance the efficiency and effectiveness of the insurance claims process, insurance companies are leveraging technological advancements, data analytics, and improved communication practices.

Technological Advancements

- Implementation of AI and machine learning algorithms to automate claims processing and reduce manual errors.

- Usage of mobile apps for easy claim submissions and real-time updates on claim status.

- Integration of blockchain technology for secure and transparent claim settlement.

Role of Data Analytics

- Data analytics helps in identifying patterns, trends, and potential fraud in claims data, leading to faster and more accurate claim assessments.

- Predictive analytics can forecast claim volumes and optimize resource allocation for efficient claims handling.

- Utilizing big data analytics for personalized customer experiences and proactive claims management.

Best Practices for Customer Communication

- Providing clear and concise information to policyholders about the claims process, timelines, and required documentation.

- Offering multiple communication channels such as email, phone, and chat for seamless interaction with customers.

- Regular updates on claim progress to keep customers informed and reassured during the process.

Enhancing Transparency in Claims Handling

- Establishing transparent claim settlement policies and procedures to build trust with policyholders.

- Utilizing online portals for customers to track their claims and access relevant information easily.

- Providing detailed explanations for claim denials or delays to ensure transparency and manage customer expectations.