Loan approval process sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with american high school hip style and brimming with originality from the outset.

As you dive deeper into the world of loan approval, you’ll discover the ins and outs of what it takes to secure that much-needed financial boost.

Understanding the Loan Approval Process

When it comes to getting approved for a loan, the process can seem daunting. However, breaking it down into key steps can help make it more manageable. Let’s dive into what the loan approval process entails.

Key Steps in the Loan Approval Process

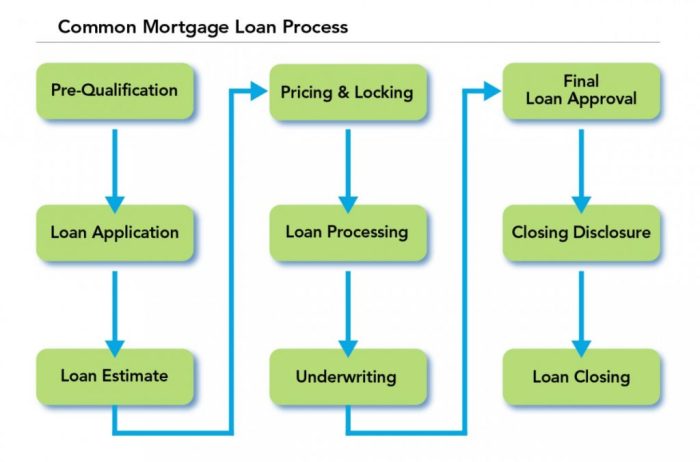

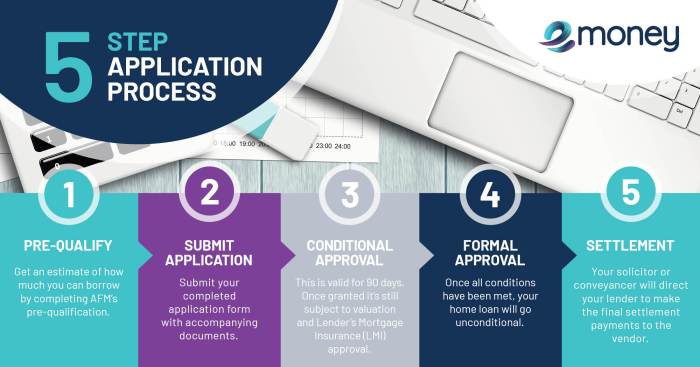

- Application: The process begins with the borrower submitting a loan application to the lender. This application typically includes personal information, financial details, and the purpose of the loan.

- Review: Once the application is received, the lender reviews the borrower’s credit history, income, and other relevant factors to assess the risk of lending to them.

- Underwriting: The underwriter plays a crucial role in the approval process by evaluating the borrower’s financial situation, the property (in the case of a mortgage), and ensuring that the loan meets all necessary guidelines.

- Approval or Denial: Based on the information provided and the underwriter’s assessment, the lender will either approve or deny the loan application. If approved, the terms and conditions of the loan will be Artikeld.

- Closing: Once the loan is approved, the closing process involves signing the necessary documents and transferring funds to complete the transaction.

Roles of Parties in the Approval Process

- Borrower: The borrower plays a central role in the approval process by providing accurate and complete information, as well as meeting any requirements set by the lender.

- Lender: The lender evaluates the borrower’s application, assesses the risk, and ultimately decides whether to approve or deny the loan.

- Underwriter: The underwriter is responsible for conducting a detailed analysis of the borrower’s financial situation and ensuring that the loan meets all necessary criteria for approval.

Documentation Required for Loan Approval

When applying for a loan, there are several documents that are typically required to complete the process. These documents play a crucial role in the approval process and help the lender assess the borrower’s financial situation and creditworthiness.

Common Documents Needed for a Loan Application

Here are some of the common documents that are usually required when applying for a loan:

- Proof of identity (such as driver’s license, passport, or state ID)

- Proof of income (such as pay stubs, W-2 forms, or tax returns)

- Proof of employment (such as employment verification letter)

- Bank statements (to show assets and liabilities)

- Proof of residence (such as utility bills or lease agreements)

Importance of Each Document in the Approval Process

Each document serves a specific purpose in the loan approval process:

- Proof of identity helps verify the borrower’s identity and prevent fraud.

- Proof of income shows the lender that the borrower has a stable source of income to repay the loan.

- Proof of employment confirms that the borrower is currently employed and has a steady job.

- Bank statements provide insight into the borrower’s financial habits and ability to manage money.

- Proof of residence establishes the borrower’s stability and ties to a specific location.

Differentiating Between Essential and Additional Documents

While the documents listed above are essential for most loan applications, additional documents may be required based on the type of loan and the lender’s specific requirements. These additional documents could include:

- Property documents (such as property appraisal or title insurance for a mortgage loan)

- Business financial statements (for business loans)

- Co-signer information (if a co-signer is needed for the loan)

Credit Score and its Impact on Loan Approval

Having a good credit score is crucial when applying for a loan. Lenders use your credit score to determine your creditworthiness and assess the risk of lending you money. A higher credit score indicates that you have a history of managing your finances responsibly, making you a more attractive borrower.

Positive Impact of Good Credit Score

- Likely to qualify for lower interest rates

- Higher loan approval chances

- Access to larger loan amounts

- More favorable loan terms and conditions

Negative Impact of Poor Credit Score

- Higher interest rates

- Difficulty in getting approved for a loan

- Limited loan options

- May require a co-signer or collateral

Loan Approval Criteria

When applying for a loan, there are certain criteria that lenders consider before approving the loan. These criteria help lenders assess the borrower’s creditworthiness and ability to repay the loan.

Types of Loans Criteria

- Personal Loans:

- Income and Employment History

- Credit Score

- Debt-to-Income Ratio

- Mortgage Loans:

- Down Payment Amount

- Property Appraisal

- Debt-to-Income Ratio

- Business Loans:

- Business Plan

- Revenue Projections

- Business Credit Score

Expedite Approval Process, Loan approval process

To expedite the loan approval process, borrowers can focus on meeting specific criteria that lenders look for. This can include improving credit score, providing accurate documentation, and having a stable income and employment history.

Loan Approval Timeline

When it comes to the loan approval process, timing is crucial. The typical timeline for loan approval can vary depending on various factors. Here’s a breakdown of what you can expect:

Factors Impacting Loan Approval Duration

- Loan Type: Different types of loans may have different approval timelines. For example, a personal loan might be approved faster than a mortgage.

- Documentation: The time it takes to gather and submit all required documents can impact the approval timeline. Make sure you have all necessary paperwork ready.

- Underwriting Process: The underwriting process, where your financial information is reviewed, can also affect how long it takes to get approved.

- Loan Amount: Larger loan amounts may require more thorough review and could take longer to approve.

Tips to Speed Up Approval Process

- Organize Your Documents: Keep all your financial documents in one place to easily access them when needed.

- Respond Promptly: If the lender requests additional information or clarification, respond quickly to avoid delays.

- Maintain Good Credit: A good credit score can expedite the approval process, so make sure your credit is in good standing.

- Choose Online Lenders: Online lenders often have faster approval processes compared to traditional banks, so consider this option.